There’s a strange paradox in CFD trading.

The longer people trade, the less they seem to trust probability — even though trading is almost entirely a probability game. I’ve been there myself. For a long time, I believed that if I refined my system just a bit more, adjusted a few parameters, or found a “cleaner” logic, the results would finally stabilize.

They didn’t.

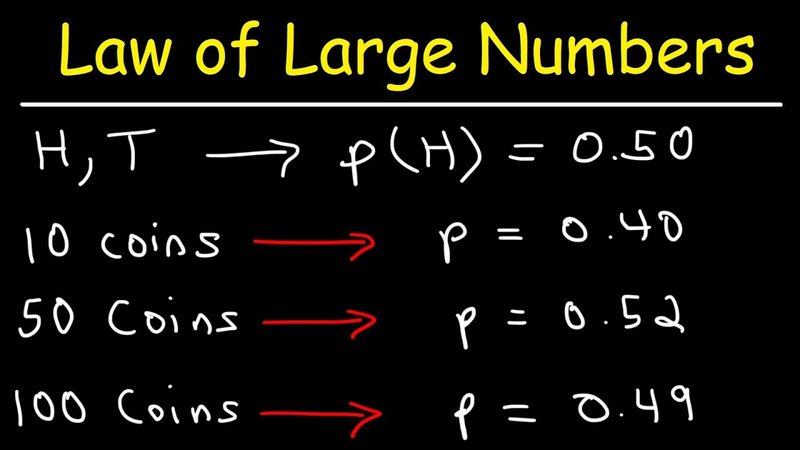

What eventually stabilized wasn’t the system — it was my understanding of how outcomes actually emerge. And that understanding forced me to accept something rather uncomfortable: most of the pain in trading doesn’t come from bad systems, but from a refusal to accept how statistics work in real life. More specifically, from not accepting the Law of Large Numbers.

When we trade, we tend to obsess over individual trades. Was this entry good? Was the timing off? Should I skip this one because the last few trades were losers? These questions sound professional, even responsible. In reality, they’re mostly a distraction. The market doesn’t pay you for individual decisions. It pays you for repeating the same behavior consistently, with a real edge, over a long enough sequence. Everything else is noise.

Stripped of academic language, the Law of Large Numbers says something very simple: if you truly have an edge, only a sufficiently large number of trades will allow that edge to reveal itself. Not sooner. There are no shortcuts. The problem is that “sufficiently large” usually means far more trades than most traders can tolerate emotionally. We want clarity early, reassurance quickly, and progress without discomfort. Probability doesn’t offer any of that.

Many traders understand expectancy perfectly well on paper. They can recite the formula without hesitation. But deep down, they still expect a positive expectancy system to shield them from uncomfortable periods. It won’t. A positive expectancy doesn’t promise a profitable week, a smooth month, or protection from losing streaks. It promises only this: if you don’t break the rules and you stay in the game long enough, the results will eventually align with the edge. And that “long enough” is exactly where most people fail.

Losing streaks are where doubt starts doing overtime. A couple of losses are manageable. Five or six in a row, and suddenly everything is under suspicion. The logic feels flawed. The market seems to have “changed character.” The system, which looked perfectly reasonable last month, now appears questionable at best. But when you look at the data instead of your emotions, the picture is far less dramatic. With a win rate around 40–50%, long losing streaks are not anomalies. They are mathematically inevitable. Not “if,” but “when.”

The irony is that many traders stop or modify their systems at exactly the wrong moment. Not because the system stopped working, but because they couldn’t tolerate uncertainty for that long. Probability continues doing its job regardless — it just does it without them once they step aside.

CFD trading is actually well suited for a large-numbers mindset. Multiple instruments, multiple timeframes, frequent opportunities. But that same abundance makes emotional interference much easier. Watching daily PnL, increasing size when things feel “in sync,” reducing risk when the rhythm feels off — all of these are subtle ways of changing the rules mid-game. And once you do that, it’s hardly surprising that the statistical outcomes no longer resemble what you expected.

The Law of Large Numbers doesn’t demand brilliance. It demands stability. Fixed risk, consistent rules, and the discipline to not interfere just because a short-term sequence feels uncomfortable. Remove that stability, and even a real edge struggles to surface.

At some point, I realized I was making trading harder than it needed to be by judging myself trade by trade. Whether the next trade was a win or a loss was almost irrelevant. What mattered was the campaign — a sufficiently large set of trades executed under the same rules. Once I started thinking that way, each individual trade lost its emotional weight. It became just another data point, not a verdict on my competence.

Drawdown looks very different from that perspective. It’s no longer a punishment or a warning sign. It’s simply part of the distribution. As long as it stays within the boundaries you accepted upfront, it’s nothing more than an operating cost. Trying to eliminate drawdown entirely usually means eliminating the edge along with it.

In the end, CFD trading isn’t a search for certainty. It’s an exercise in accepting uncertainty — but doing so professionally. You don’t need to win often. You don’t need to be right all the time. You just need a small but genuine edge, and enough discipline to avoid sabotaging it before probability has time to speak.

The Law of Large Numbers doesn’t make trading more comfortable. It won’t reassure you during drawdowns or make the rough periods feel shorter. But if you truly accept it, it gives you something far more valuable: the ability to stay in the game long enough. And in trading, survival alone is already a significant advantage.

Comments (0)

Please sign in to comment.

No comments yet. Be the first to comment!